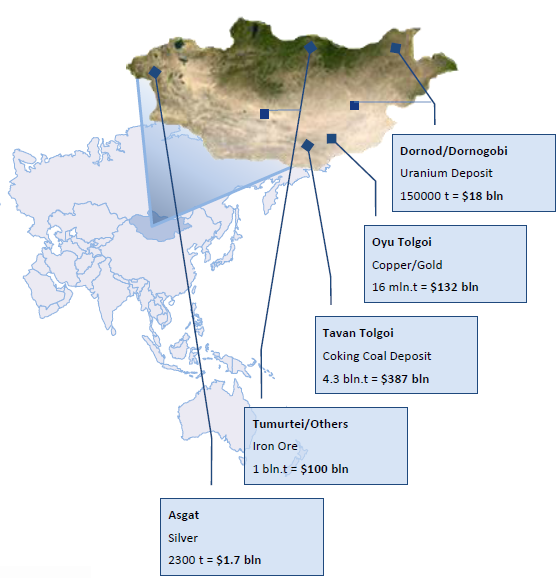

Electricity demand in Mongolia - major driver from world-class mineral deposits

The dramatic and continuing rise in Mongolia's energy demand is being driven by the rapid development of the country's mining based economy. During the period of 2007‐2011, electricity consumption in Mongolia increased on an average of 6% per year. However, the Ministry of Mineral Resource of Mongolia estimates that overall electricity demand is expected to grow at 14% in the future. Major international mining firms have become involved in developing Mongolia's over-abundance of resources, including 15 world-class strategic mineral deposits with an estimate resource value of over $1.2 trillion. Projects of this magnitude require vast quantities of power from reliable sources.

Figure1. Typical strategic deposits in Mongolia

Source: Mongolia stock exchange

Southern Mongolia - Richly endowed with Natural Resources but lacking power

The South Gobi region, in south of Mongolia, is currently isolated from the Central energy system. The mines of South Gobi (

SGQRF.PK) that are in operation must, therefore, supply their own electricity. Power demand in that region is expected to grow rapidly as a result of both the existing and new mining developments. The two biggest current players in South Gobi are:

- Oyu Tolgoi (OT) - a world-class gold and copper mine being developed by Ivanhoe Mines. The deposit is estimated to hold over 35 million tonnes of copper and 1,275 tonnes of gold. According to the Mongolia Stock Exchange, OT is poised to generate $61 billion over 27 years.

- Tavan Tolgoi (TT) - the largest undeveloped coal deposit in the world. Mongolia is estimated to hold reserves of over 6 billion tonnes of coal. The Mongolia Stock Exchange estimates that TT will be operable for 200+ years, with an annual return of $1.6 billion for the first 29 years.

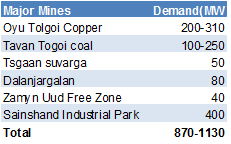

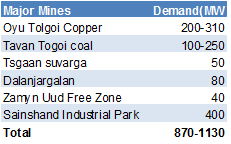

A presentation by the Ministry of Mineral Resources and Energy of Mongolia forecasts total demand from major customers in the South Gobi region of around 870MW to 1130MW.

Figure 2. Forecast electricity demand from major South Gobi mines:

Source: The Ministry of Mineral Resources and Energy of Mongolia

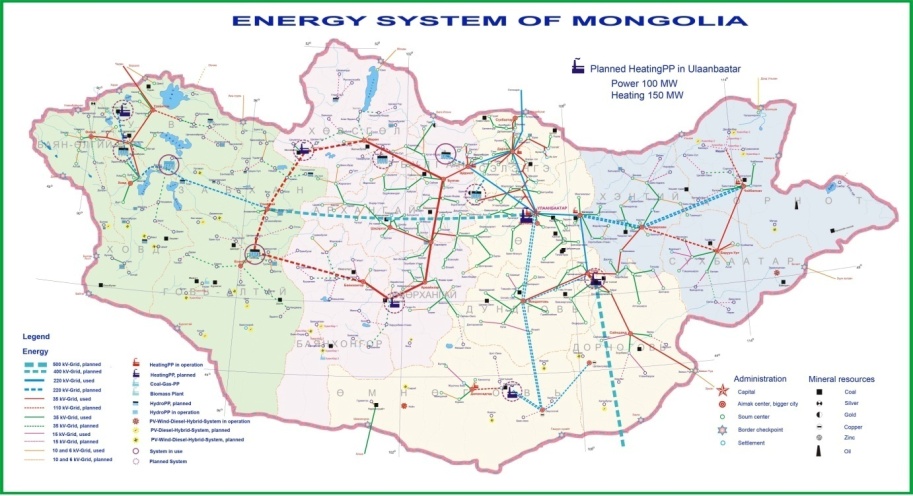

Power supply in Mongolia - dominated by the central energy system

The power system of Mongolia consists of the three unconnected energy systems (the Central, Western and Eastern Energy Systems), diesel generators and heat-only boilers in off-grid areas. In total, 91% of the country's electricity is produced by the Central Energy System and 96% of the electricity demand of the country is met by the CES.

Figure 3. Map of Mongolia power systems

Source: Energy Regulatory Authority of Mongolia

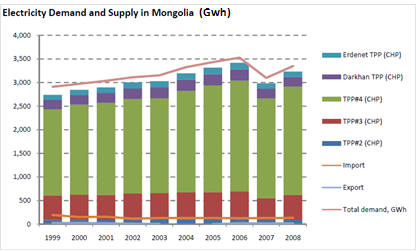

The electricity and heat is supplied by five combined heat and power (CHP) plants. The limited installed capacity of these existing power plants results in an ongoing and increasing energy deficit which is currently being offset by costly and unreliable electricity imports from Russia.

Figure 4. Electricity supply breakdown and demand

Source: Energy Regulatory Authority of Mongolia, Eurasia Capital-INFRASTRUCTURE IN MONGOLIA April 2009

Coal fired power plants - Critical to Mongolia energy system

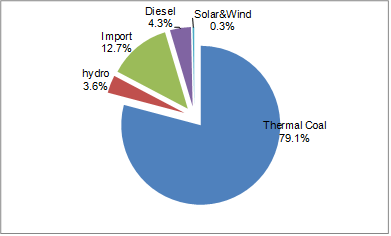

As the primary source of energy for Mongolia, the coal industry is critical to the operation of Mongolia's energy system. According to the Ministry of Mineral Resource and Energy of Mongolia, Mongolia's electricity generation capacity is comprised of 7 thermal power plants, 13 hydroelectric power plants, several hundred diesel generators, 20 wind power plants and 1 solar power plant. Of these sources, the overwhelming supply of electricity comes from coal-fired plants, which generate approximately 80% of the country's power.

Figure 5. Electricity generated by source in Mongolia

Source: Mongolia national renewable energy program

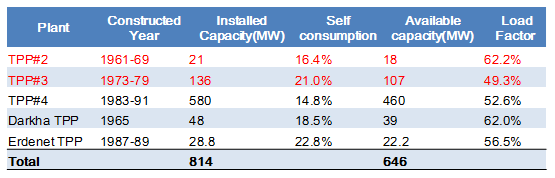

There are five major thermal power plants (TPP) in the Central Energy System (CES). The current installed power capacity for coal fired power plants in Mongolia is 814 MW, but only 646 MW is available because of aging power plants, with most being over 30 years old. Because of age and deterioration, the TPP #2 is expected to retire in 2012 and the TPP #3 is expected to retire in 2016. Because Mongolia's capital, Ulaanbaatar, relies so heavily on these plants and lacks any replacement power source, they have to be kept in operation well past their lifespan.

Figure 6. Current coal fired power plants in CES

Source: Energy Regulatory Authority (2007), Eurasia Capital.

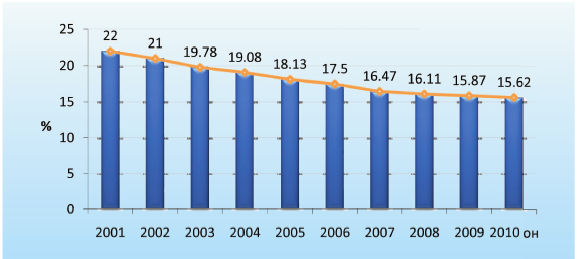

The aging of the existing power plant infrastructure results in energy inefficiency and electricity loss due to 1) lower actual available power capacity and load factors and 2) Higher self-electricity consumption in power plants. The Mongolian government acknowledges this as a major issue and aims to reduce the whole system loss of the CES but the electricity loss remains a significant area of concern that will need to be addressed.

Figure 7. Total system electricity loss in CES

Source: Energy Regulatory Authority of Mongolia-2010 annual report

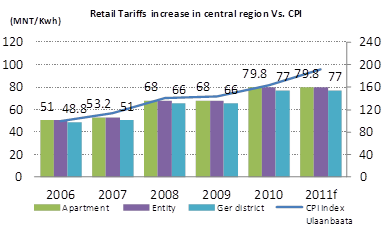

Due to government regulated low electricity and heat tariffs, energy producers and thermal coal suppliers were historically unable to operate profitably. Companies operated with support by international loans and grants, and state budget subsidies. In late 2010, the parliament of Mongolia approved step by step liberalization of energy tariffs. The sector is planned to operate based on market principals beginning in 2014. Electricity tariffs are expected to increased to ease the operating pressure of power suppliers due to: 1) the increase of retail tariffs lagging behind the CPI and 2) wholesale tariffs increasing to maintain service level 3) licensees facing cost pressure from increasing input prices.

Figure 8: Retail Tariff Vs. CPI

Source: ERA annual report 2009, 2010 and Website, World bank-Mongolia Quarterly Economic Update Aug 2011,

Potential source of power

1. Renewable energy - challenge for the ambitious plan

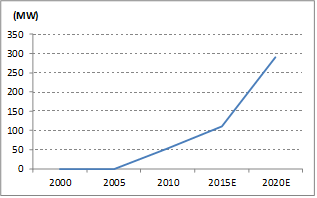

Currently, renewable energy (hydro, solar and wind) only represents about 4% of Mongolia's total electricity generating capacity. In the most remote areas, because of low demand and lack of other energy sources, use of renewable energies is viable. The Mongolian government passed the Renewable Energy Program in 2005, mandating that green energy sources account for 20-25 percent of Mongolia's needs by 2020. Solar photovoltaic and wind power have potential in Mongolia given the country's vast steppes and ample wind.

Figure 9: Mongolia renewable energy program forecast

Source: Energy Authority of Mongolia

Modern solar cells are lightweight and portable enough to mesh well with a lifestyle involving frequent travel. Because of that, in Mongolia, solar energy use has mainly focused on decentralized individual solar home electricity systems, which would also be suitable for larger scale solar energy applications.

In terms of wind power, one Mongolian company, Newcom Group, will start construction of the first sizable wind power plant in Mongolia, with an installed capacity of 50MW.

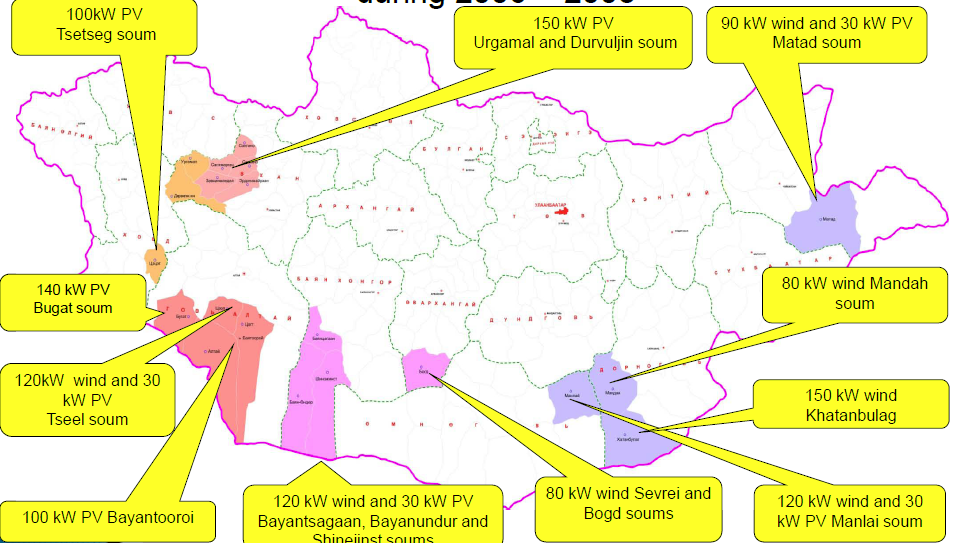

Figure 10: Renewable power plant in remote area during 2006-2008

Source: Energy authority of Mongolia

While a laudable goal, the practical reality of implementing such an ambitious renewable energy plan, particularly for wind power plants, is rife with significant obstacles. According to the Energy Authority of Mongolia, real-world problems include: 1) frequent performance problems; 2) a shortage of the government financing needed to acquire high quality small wind turbines; 3) contract-awarded inexperienced national companies had financial loss due to repetitive repair.

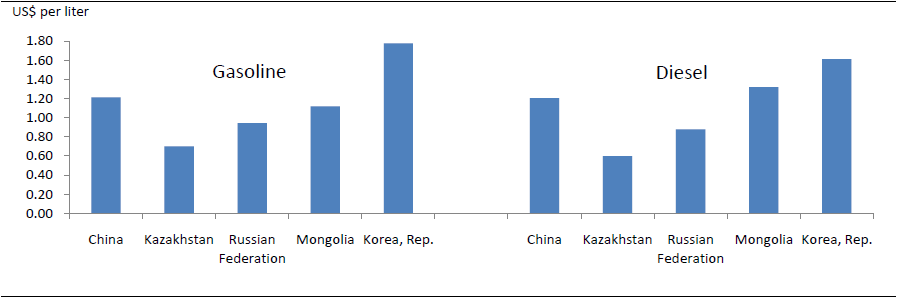

2. Diesel generators - unstable diesel supply and high cost

Diesel generators are popular in remote areas with no connection to the grid. In the South Gobi region, the Tavan Tolgoi mine is building a 20MW diesel power plant as a temporary electricity solution. Two major problems need to be solved for diesel power plants to be viable long-term:

1) The unstable supply of diesel.

Mongolia sources over 90 percent of its fuel from Russia. These imports are unstable as Russia may suddenly curtail its fuel exports as it has done in the past. This has the corollary effect of driving up domestic prices.

2) The high operating cost for using diesel to generate power.

Because Mongolia is forced to import diesel to offset its domestic energy needs, the selling in that country is higher than China, Kazakhstan and Russia. This also places Mongolia in a vulnerable position with respect to import tariffs. In May 2011, Mongolia experienced a severe fuel crisis as Russia raised duties on fuel exports by over 40 percent. Such actions particularly affect mining, agriculture and construction because these sectors have only a short operational season before the onset of winter.

Figure 11. prices of gasoline and diesel in June 2011

Source: Mongolia Quarterly Economic Update-2011 Aug

3. New Coal-fired power plant - The ideal for powering Mongolia's future.

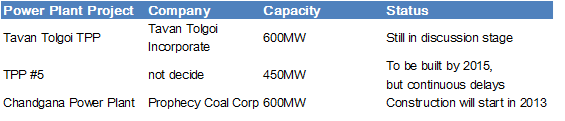

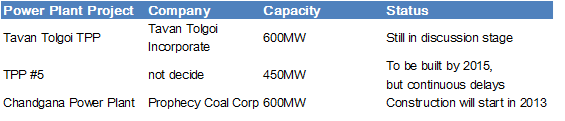

Although alternative energy sources will continue to be developed, until technology and efficiency dramatically improve, the solution to Mongolia's energy crisis lies in coal. The country has total coal reserves estimated at 150 billion metric tons, and three major coal fired power plants are planned to be built in order to meet the growing demand.

Standing out among these projects is Prophecy Coal Corp's (

PRPCF.PK) 600 mega-watt Changdana thermal coal power plant. The first sizable new power plant in Mongolia in decades, the Chandgana project is fully-licensed and endorsed by the government. Construction is expected to commence in the second quarter of 2013, with power on anticipated for Q4 of 2015. The Prophecy project is in the advanced stages as compared to the other proposed projects, with the company looking to finalize a power purchase agreement with the Mongolian government in the coming months.

Figure 12. Major Coal fired Power Plants in progress

Source: The world bank-Mongloa:Power Sector Development and South Gobi Development, Prophecy Coal Corp company presentation

How to play- trading vehicle for capturing energy exposure in Mongolia

North American investors can share the gain of energy industry in Mongolian by having the exposure in the stock of the public listing companies, which devoted themselves to the energy development in Mongolia. Such companies include:

1.

Prophecy Coal Corp, the Canadian company which plan to build 600MW coal fired power plant in Mongolia. The company has over 1.4 billion tonnes of surface minable thermal coal resources on two coal properties in Mongolia. Prophecy's Ulaan Ovoo coal mine is in production and its Chandgana mine mouth power plant has been permitted. (Declare: I do not have any options and stocks for Prophecy Coal Corp, GE electric and Ivanhoe Mines, and no plans to initiate any positions within the next 72 hours).

2. GE electric, this US conglomerate help build Mongolia's first wind energy park in a $100m deal with Newcom, a Mongolian private investment company. (Declare: I do not have any options and stocks for Prophecy Coal Corp, GE electric and Ivanhoe Mines, and no plans to initiate any positions within the next 72 hours)

3.

Ivanhoe Mines (

IVN): Core assets in Mongolia are Ivanhoe's 66% interest in the world-scale Oyu Tolgoi copper and gold mine project and its 58% interest in Mongolian coal miner SouthGobi Resources. The company plan to construct the coal-fired power plant in Mongolia, which mainly for the self use of Oyu Tolgoi copper-gold mine project, but not in near term.

Conclusion

The leaders and people of Mongolia have long-recognized its potential as a modern, booming economy and international firms continue to embrace it as evidenced by massive and increasing foreign investment. With this expansion, Mongolia's critical energy shortages are expected to become more and more pronounced as new draws strain the existing supply and further increase reliance on costly and unstable imports. To sustain its impressive development, it is vital that the Mongolian government address the energy situation by utilizing their abundant coal resources and that they do so in the most efficient, modern and clean facilities technology has developed.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Prophecy Coal Corp. Neither Prophecy Coal Corp. nor the author can guarantee accuracy of all information provided. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in precious metal products, commodities, securities or other financial instruments. Prophecy Coal Corp. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication. I am a private investor and currently hold the position of Investor Relations Officer with Prophecy Coal Corp. (TSX: PCY and Prophecy Platinum Corp. (TSX.V: NKL).

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

By Leo Liu