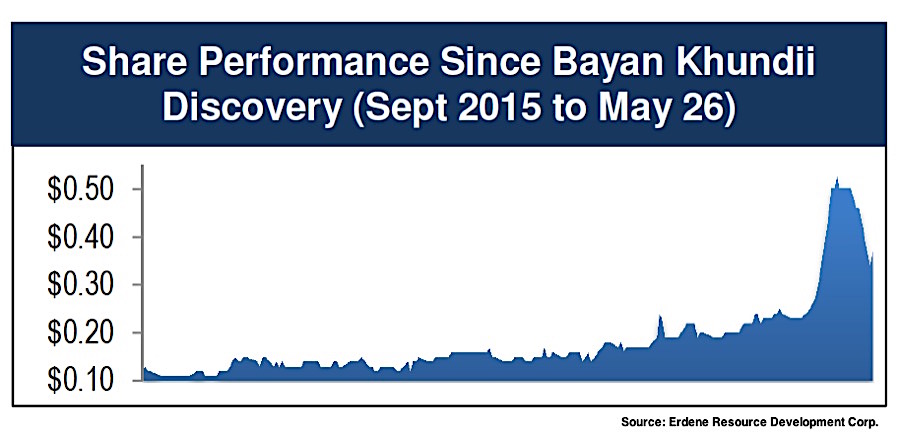

Canada’s Erdene Resource (TSX:ERD), one of the very few miners to never have encountered issues in Mongolia, has seen its shares soar in the last few months after the company hit the jackpot with a new multi-ounce gold discovery in the country’s southwest.

Erdene’s new darling, the Bayan Khundii project, went from greenfield prospect to the company’s flagship asset in roughly nine months.

One of the most remarkable characteristic of this new discovery, said Erdene’s vice president and CFO Ken MacDonald in a recent presentation at a mining convention in Nova Scotia, is that at Bayan Khundii gold can be observed at surface, and not only in one or two spots, but at several holes and trenches.

“We knew we had something important in our hands when we noticed local gold prospectors coming daily to the area, with just a few tools to scratch the rocks and land,” he said.

Located within the mineral-rich Tian Shan Gold Belt, 160 km from the border with China, the project’s first drilling results show that Erdene’s executives intuition wasn’t wrong.

The Halifax, Nova Scotia-based miner announced fresh results Tuesday for a 3,845-metre drill program that began in April to follow up on initial figures and test more prospect areas over a 1.7 km trend.

This, the third batch of results, proves the presence of high grade gold in multiple holes and trenches, ranging from 11.2 to 30.3 g/t gold, Erdene says.

Those numbers, together with a clearer socio-political landscape in the country, courtesy of Rio Tinto’s (LON: RIO) successful investment negotiations at its Oyu Tolgoi copper-gold mine, have helped Erdene attract the interest of other industry key players, such as Sandstorm Gold (TSX:SSL).

Erdene recently completed a $2.5 million financing and royalty sale with the Vancouver-based bullion miner. And earlier this month, the firm secured a $500,000 private placement from copper exploration partner Teck Resources (TSX:TCK.A) (NYSE:TCK), Canada’a largest diversified miner.

Investment picking up

Erdene Resource’s vice president and CFO, Ken MacDonald, is optimistic about Mongolia's stance towards foreign mining investment over the coming years.

MacDonald believes the recent rout in commodities prices made Mongolia realize how reliant it is on its natural resources and the importance of keeping foreign investors happy.

In his presentation, he highlighted several key changes in recent months that hint to a government’s new attitude, including a reduction in gold royalties and the granting of key permits to Centerra Gold (TSX:CG) for its Gatsuurt project.

Earlier this year, the Asian country also launched a new program aimed to attract a fresh wave of mining exploration.

Investors’ confidence is building up as a result. At the end of 2015, the National Bank of Canada bought 10.5% stake in one of Mongolia’s top banks. Shortly after, a series of Canadian government-funded mining projects were approved. Then, in May, Robert Friedland’s group merged with Kincora Copper (CVE:KCC) in an effort to consolidate the southern Gobi copper belt.

Landlocked Mongolia, once known as “Minegolia” due to the interest generated by its vast unexploited reserves of copper, coal and other minerals, would benefit from the renewed interest from foreigners.

According to the World Bank, the country’s population risks being dragged back below the poverty line as the economy sinks. Mongolia’s unemployment rate jumped to 8.3% in the final quarter of 2015, from 6.3% a quarter earlier.

In January, the World Bank cut the country’s growth forecast this year to just 0.8%. Two years ago, it forecast growth of 7.7% for 2016.

Source:http://www.mining.com/

0 comments:

Post a Comment